The following help article provides general instructions on how to complete this form in Wrapbook. If you have questions about how to complete tax information based on your specific situation, consult with a CPA or other tax professional.

Overview of Form W-9

A W-9 is a tax form used by the IRS to collect information from U.S. contractors and loan-out companies. It serves several important purposes:

Collects your Taxpayer Identification Number (TIN) - either your Social Security Number (SSN) for individuals or Employer Identification Number (EIN) for loan-out companies

Verifies your tax classification - particularly important for loan-out companies, which must be either S Corporations or C Corporations when working with Wrapbook

Provides certification that:

Your TIN is correct

You're not subject to backup withholding

You are a U.S. person

The information you provide on your W-9 must exactly match your tax records to ensure accurate tax reporting.

Who needs to complete Form W-9

Form W-9 (Request for Taxpayer Identification Number and Certification) is required for all U.S. contractors and loan-out companies working through Wrapbook.

Why Form W-9 is important

Workers classified as loan outs must complete Form W-9 In order to use Wrapbook. If you don't fill out a W-9 when required:

You won’t be able to submit your timecards or receive payments

You may be subject to backup withholding, where the payer must withhold a percentage of your payments to ensure tax compliance

Your payments will be subject to mandatory 1099 reporting regardless of the amount

How W-9s are completed in Wrapbook

In Wrapbook, if you’re classified as a loan-out worker, your primary details and the information required for Part I of the Form W-9 are automatically added to your Form W-9 based on the information in your Loan-out Info.

This information includes:

Company Legal Name

DBA

EIN

Federal Tax Classification

Address

Jurisdiction of Incorporation

Article of Incorporation

You can update this information only if you haven’t received a payment from Wrapbook.

To update your W-9 information as a loan-out worker:

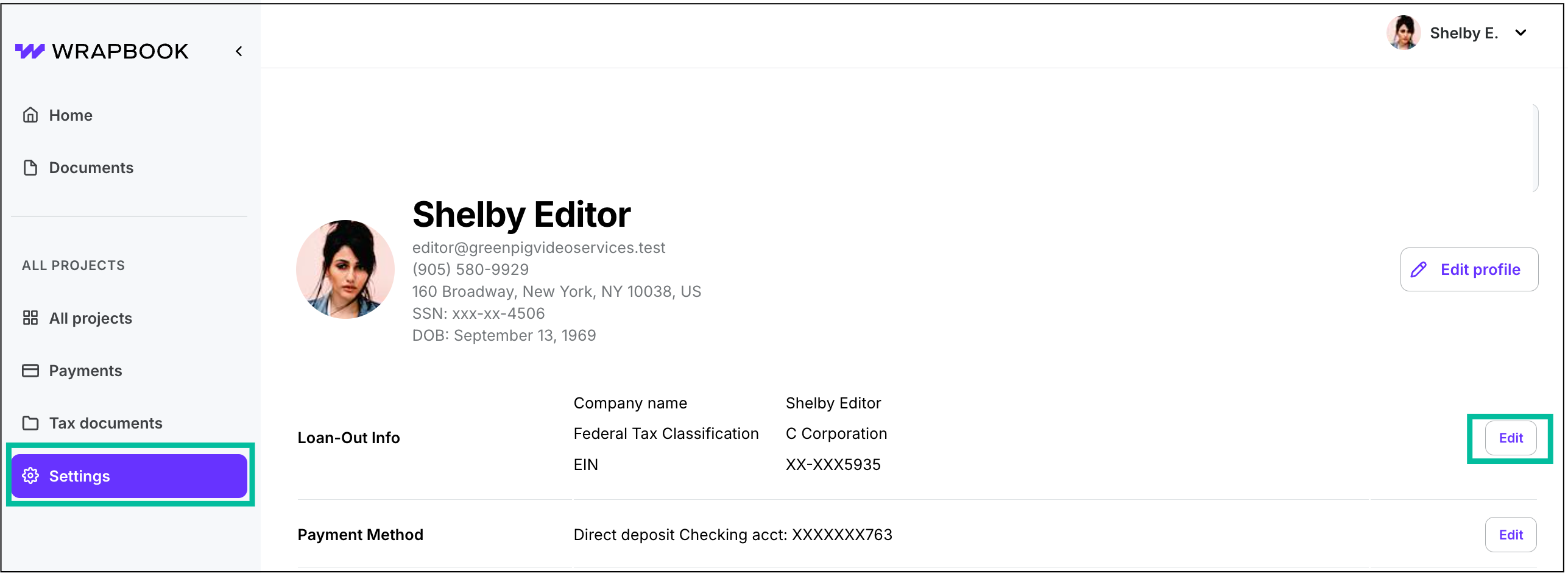

In the left-side navigation, click Settings

On your Settings page, click the Edit button next to Loan-Out Info

After you’ve made your changes, click the attestation and then click the Save button. Once you do this, your W-9 in Wrapbook will be automatically updated to include the new information.

If you’ve already received a payment, this information will be locked. In this case you’ll need to reach out to our Support team for help updating this information.

Click Settings, then click the Edit button next to Loan-Out Info

How to find your Form W-9 in Wrapbook

In Wrapbook you can access Form W-9 from your Tax documents.

To access:

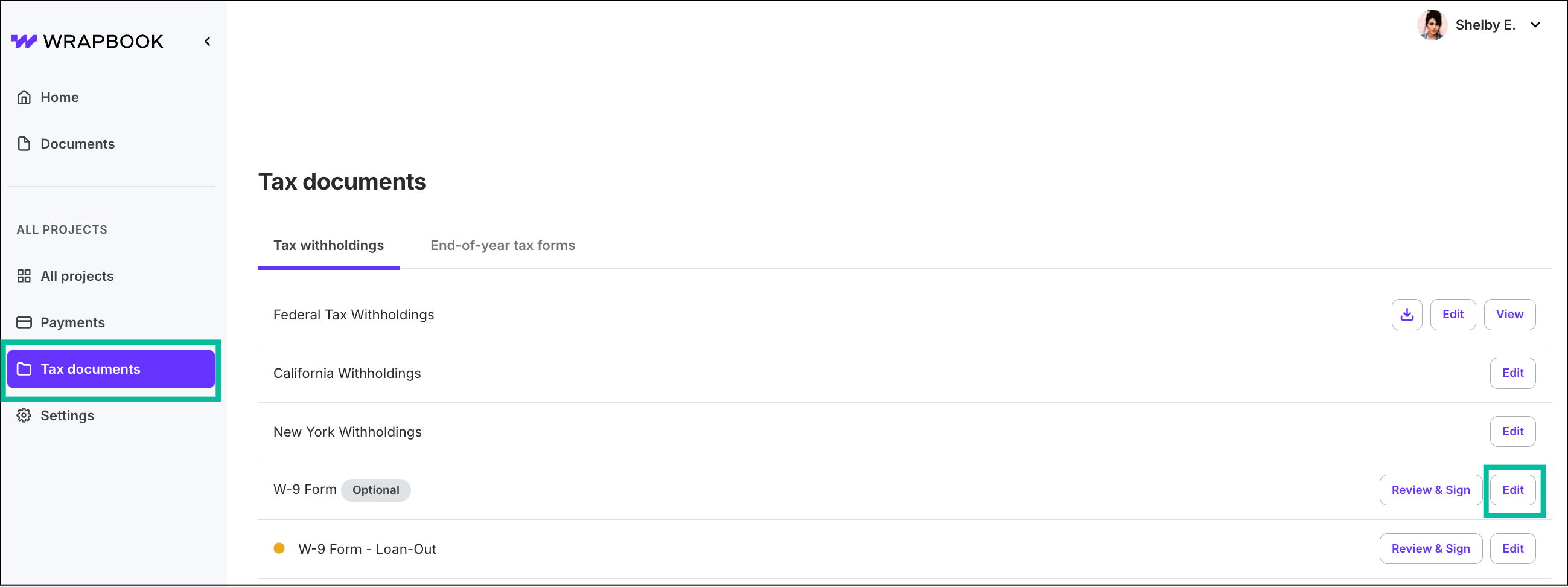

In the left-side navigation, click Tax documents

Your W-9 will be listed on the page. Click the button next to it to view its details.

How to enter Form W-9 exemptions and/or backup withholding

To update the exemption information that appears in Box 4 of your Form W-9 in Wrapbook and/or your backup withholding information:

In the left-side navigation, click Tax Documents

Click the Edit button next to W-9 Form.

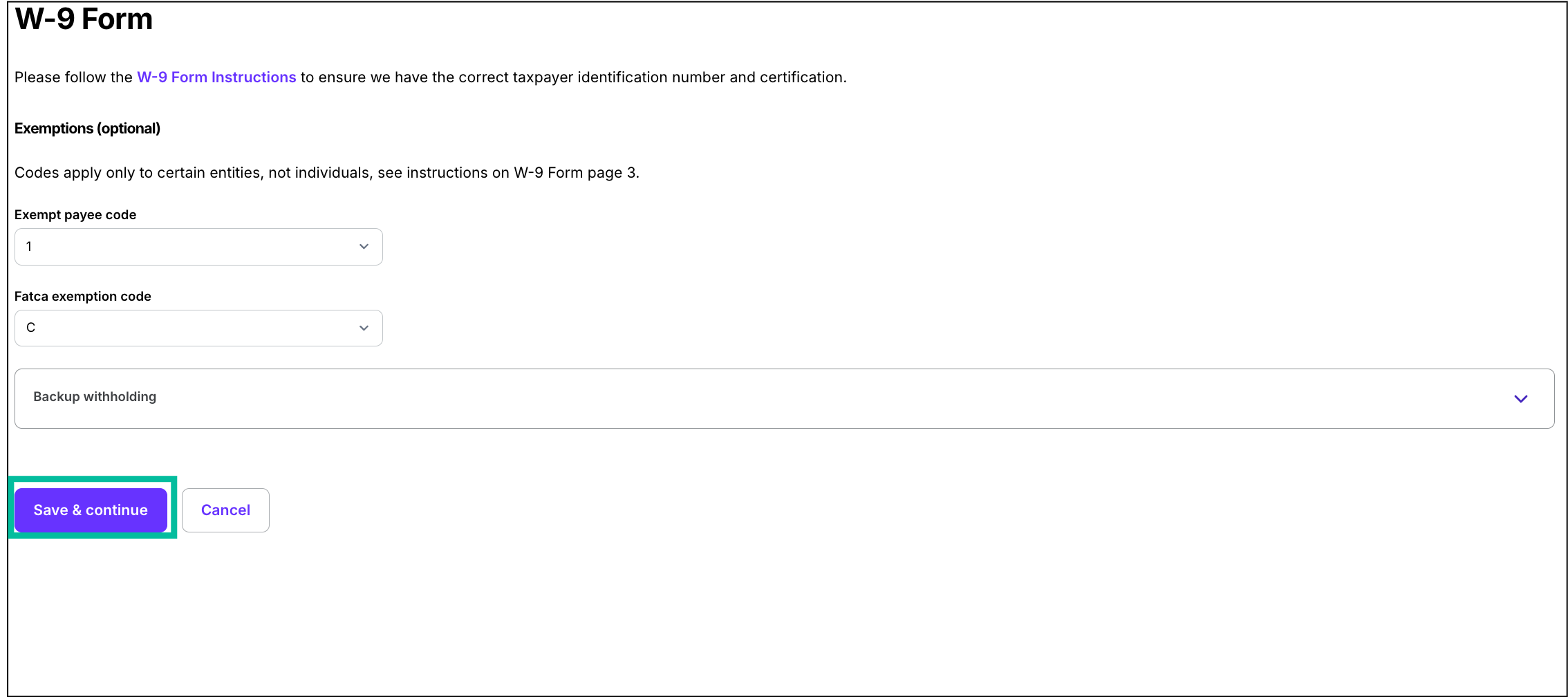

Click the dropdown menus to update your exemptions and/or backup withholding information. If you make updates to your exemptions and/or backup withholding information, be sure to click the Save & continue button to re-sign your W-9 Form. Note that the changes will be reflected going forward only. Changes are not retroactive.

Click Tax documents, then click the Edit button next to W-9 Form

Click any of the fields to make your updates, then click the Save & continue button

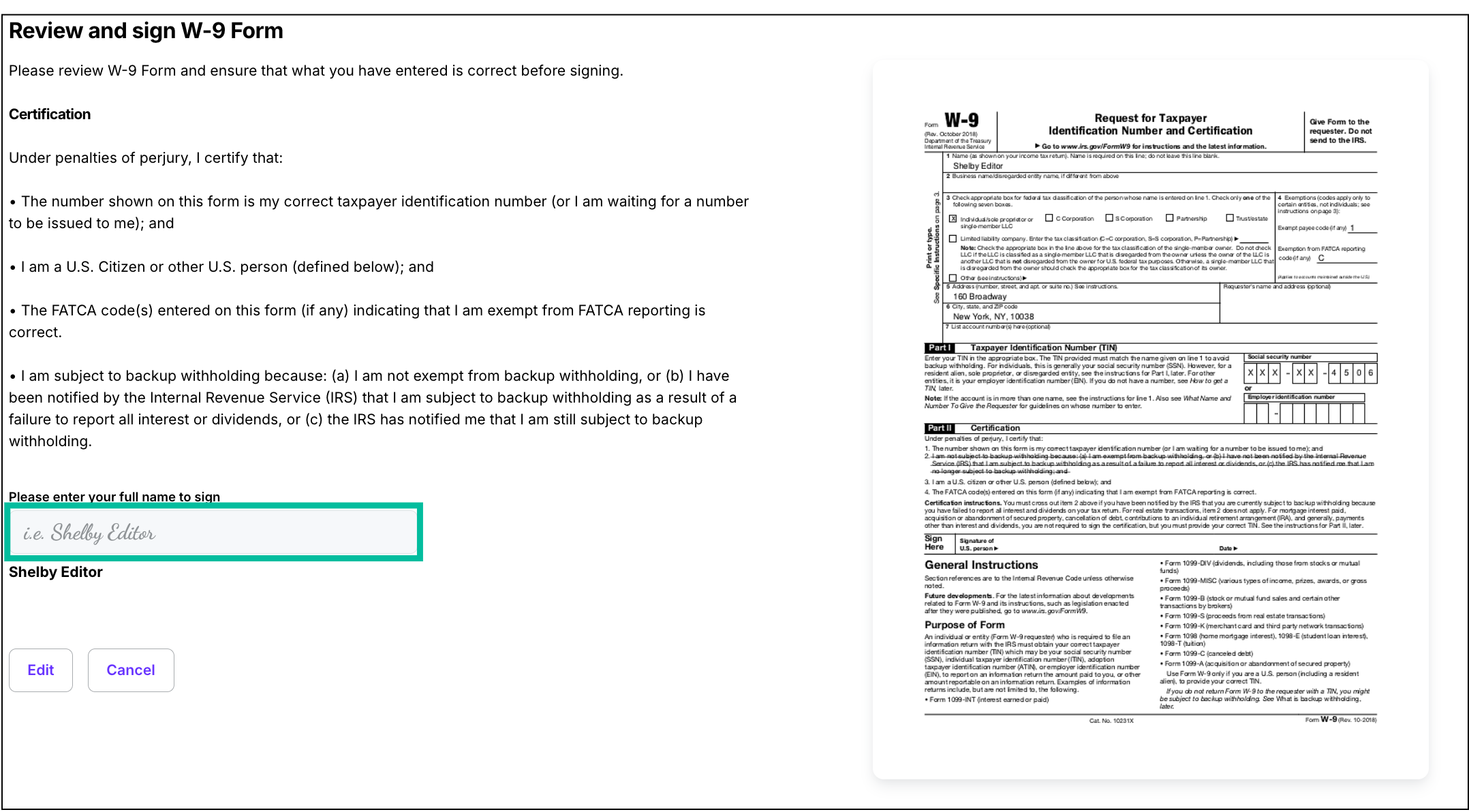

How to sign your Form W-9

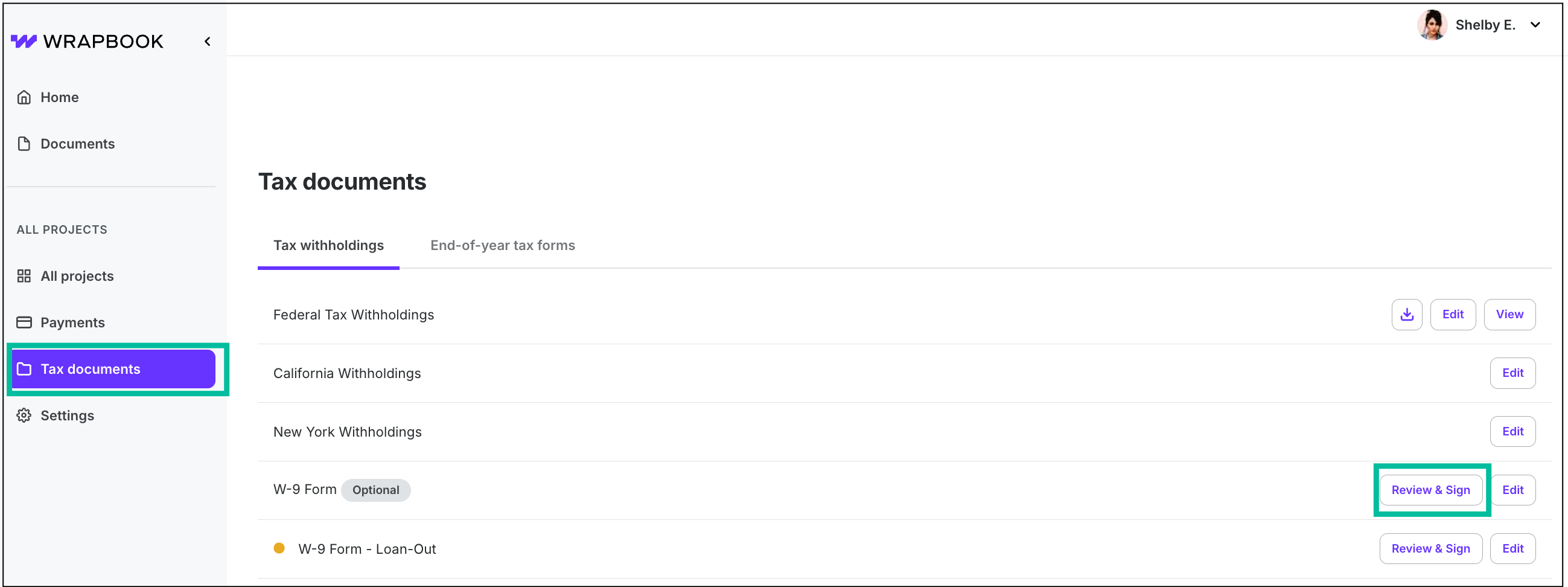

In the left-side navigation, click Tax Documents

Next to W-9 Form click the Review & Sign button

On the Review and sign W-9 Form page, under Please enter your full name to sign, click the field to enter your full name as it appears in the Form and then click the Submit button

Click Tax documents, then click the Review & Sign button next to W-9 Form

Important Notes

All information must match your tax records exactly

If the information entered in your Settings, Loan-Out Info or Profile indicates that you should complete a Form W-9, you’ll be automatically prompted to review the information entered in the Form, sign, and date during project onboarding

The W-9 Form must be signed and dated to be valid

If you haven’t been paid through Wrapbook before, you can delete your W-9 information or update it. If you’ve been paid through Wrapbook before or otherwise need help removing or correcting your W-9 information in Wrapbook, please contact the Support team.

Backup Withholding

Backup withholding is a tax requirement where a payer must withhold a percentage of payments to ensure tax compliance.

When backup withholding applies, 1099s must be issued regardless of the payment amount

For loan-out companies, this means:

Wrapbook becomes the payer of record

1099s are issued with Wrapbook's tax ID (FEIN) instead of the client's

Backup withholding may be required in certain situations, such as:

If you provided an incorrect TIN (Taxpayer Identification Number)

If you have previously underreported interest or dividend income

If you have failed to report interest, dividend, or patronage dividend income to the IRS

If you failed to certify that you're not subject to backup withholding

When you sign the W-9, you are certifying that you are not subject to backup withholding. If circumstances change and you become subject to backup withholding, you must notify the payer.