In Wrapbook, project workers can access their completed W‑4s, W‑9s, W‑2s, and 1099s from the Tax Documents dashboard.

To see your tax documents:

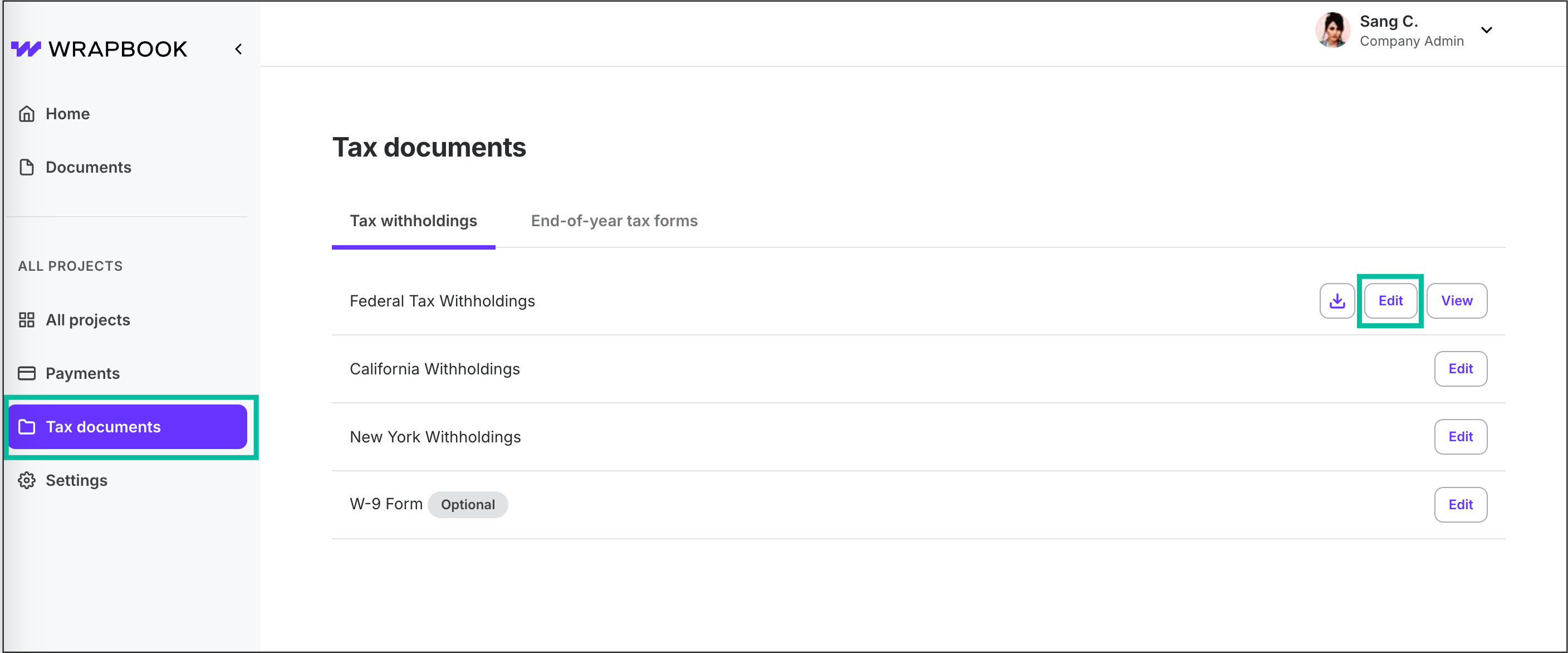

In the left-side navigation, click Tax Documents

.png)

In the left-side navigation, click Tax documents

On your Tax documents dashboard are two tabs that you can click:

Tax withholdings

End-of-year tax forms

Tax withholdings

Click the Tax withholdings tab to view documents like:

W-4s

W-9s

State or local tax withholding forms

End-of-year tax forms

Click the End-of-year tax forms tab to view documents like:

W-2s

W-9s

End-of-year tax forms for each calendar year will be available in your Wrapbook account by January 31st of the following year. If you've opted to receive physical copies, they’ll be postmarked by January 31st.

Tax documents FAQ

We’ve put together this list of frequently-asked questions about the tax documents that you can manage with Wrapbook.

Click the arrow next to a question to see the answer.

How do I change my tax withholding?

To change your tax withholding:

In the left-side navigation, click Tax documents

On your Tax documents dashboard, click the Edit button next to the withholding that you want to adjust

On the withholding page, make your changes and then click the Save & continue button

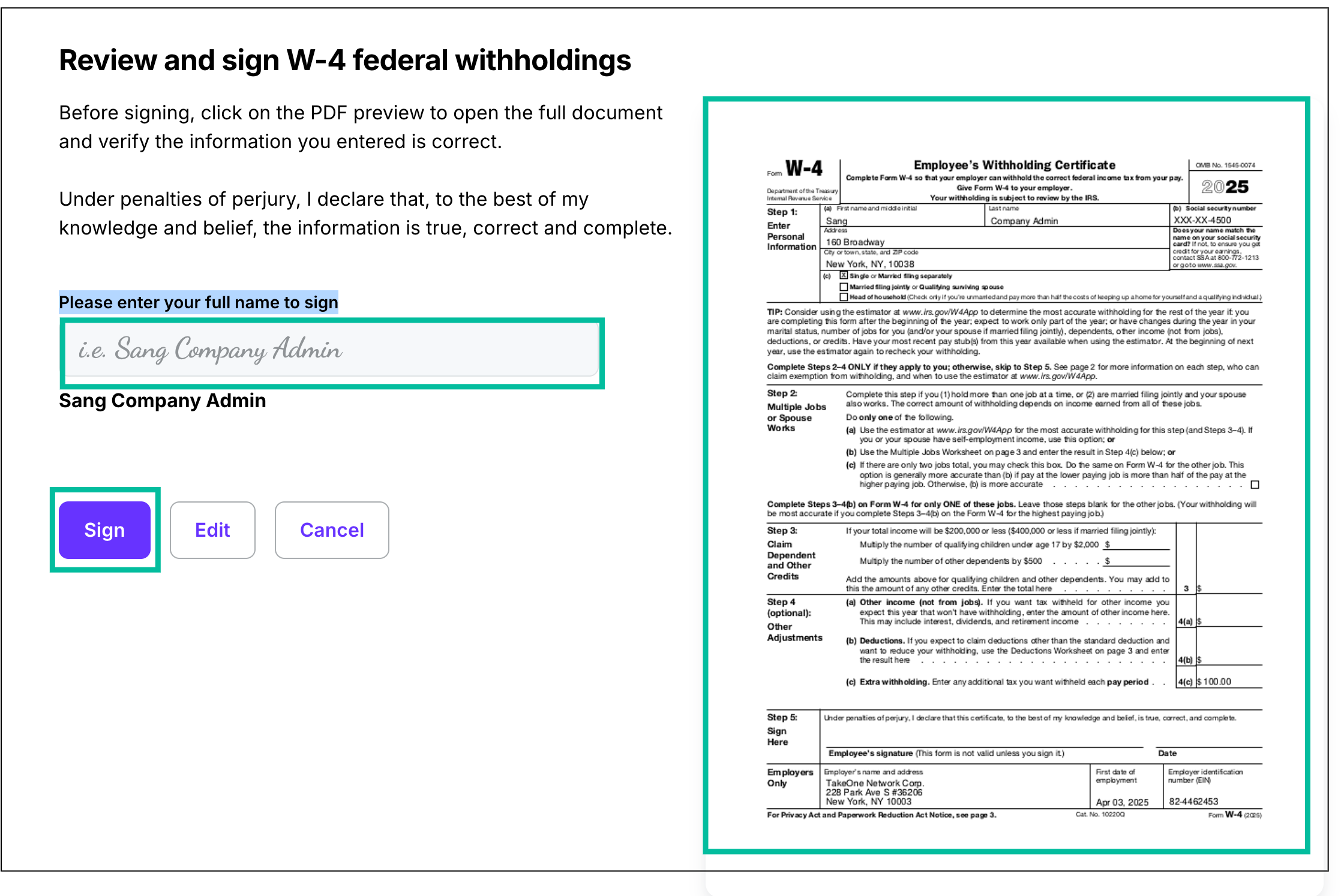

On the Review and sign page, review your updated form

If everything looks correct, enter your full name in the signature field, and then click the Sign button

Click Tax documents, and then click the Edit button next tot he withholding form you want to update

Review the form and then enter your full name, and then click the Sign button

When will my W-2 be mailed?

Paper W-2s will be postmarked by January 31, 2026.

Once issued, you can access the PDF version of your W-2 by doing the following:

In the left-side navigation, and click Tax documents

On the Tax documents dashboard, click the End-of-year tax forms tab

To opt-out of receiving a paper copy:

Click Settings

Next to End-of-year tax forms, click Edit

Scroll down to Electronic Tax Form Opt-In to update your selection

Once you've made your selection, click Save

What if I haven't received my Form W-2 or my mailing address has changed?

If your mailing address has changed, you have until January 2, 2026 to update the information in Wrapbook to ensure your 2025 W-2 is sent to the correct address.

Electronic copies of your W-2 can be retrieved through your Wrapbook account under Tax Documents.

To see your tax documents:

In the left-side navigation, and click Tax documents

On the Tax documents dashboard, click the End-of-year tax forms tab

Why is Box D empty on my W-2, but is required for me to complete my filings with Turbo Tax?

Since we submit all filings electronically, a control number isn’t required in box D.

To proceed with completing your filing in TurboTax you can enter 00000 00000.

Why are my W-2 wages less than what I should have made annually?

Form W-2 reflects taxable wages for payments issued during the tax year, regardless of when the work was completed and earned.

There may be times where the pay period ends in one year but the payment date is in the next year.

Taxable wages are recognized on the payment date, and don’t include items such as non-taxable reimbursements and most mileage reimbursements.

Taxable wages will also be lower if you have Section 125 health benefits, flex benefits, or other fringe benefits.

Why is the year-to-date (YTD) gross on my pay statement different from what is shown in Box 1?

Your YTD may be different if you worked on multiple projects. The YTD gross doesn’t take into account any items that would reduce your taxable income.

Some items that would reduce Box 1 are:

Pre-tax health benefits: medical, dental, vision

Pre-tax retirement plans: 401(k) is an example

Health Savings Account (HSA): reduces taxable wages in most states

I worked in multiple states. Will I be receiving multiple Form W-2s?

You’ll receive one W-2 with multiple pages that list each state where you had taxable wages reported.

I didn’t work in New York the entire year. Why is Box 16 showing wages equal to Box 1 on the W-2?

Regardless of whether or not you’re a resident of New York, or only worked in New York for a day, the state requires all wages in Box 1 to be reported in Box 16.

When you file the proper New York personal income tax return, you may use your pay stub(s) to calculate the actual wages earned in New York, and the state may determine the percentage of time worked in New York.

Click here to see New York state information about non-resident income tax.

Please reach out to a tax professional if you need assistance.

Box 16 is showing wages equal to Box 1 on the W-2, even though I didn’t work in the state the entire year. Is that accurate?

The state where you’re a resident is where all wages were earned (regardless of where you worked) and are reportable. For this reason, Box 16 may display wages even if you didn’t have income taxes withheld for your resident state.

You may have also worked in multiple states and were withheld state income tax for those states. When you file your personal tax return, you must file a resident tax return (if required), as well as a non-resident tax return in any state where taxable wages are reported. Some states will allow you to take credit against income tax paid in other states. Please reach out to a tax professional if you need assistance.

I moved to another state. So why does Box 16 show wages equal to Box 1 on the W-2, even though I didn’t work in that state the entire year?

Some states have a 183-day domicile rule to determine if they consider you a full-time resident for tax purposes.

States may also have additional requirements to make a determination.

You’ll be required to file the correct personal income tax return for both states (if the new state you live in requires one), and those states will determine the income tax calculation.

Please reach out to a tax professional if you need assistance.

I moved to another state and did not work there at all. So why is Box 16 showing wages?

Review your Wrapbook account and make sure you have updated your address appropriately.

If you did update it, or you updated after receiving wages through Wrapbook prior to the change, Box 16 may show wages.

We cannot create a corrected W-2 for address changes (since there is no correction field for that) so you’ll need to file the appropriate personal income tax returns to report it.

Please reach out to a tax professional if you need assistance.

I was employed by multiple (non-Wrapbook) companies. Why are my withholdings over the Social Security wage limit?

The maximum wages subject to Social Security for tax year 2025 is $176,100.00, and the total tax withheld is in Box 4 (Social Security Tax Withheld).

When you file your personal income tax return, your total wages earned will be consolidated and recalculated along with what should have been withheld.

What are the maximum wages subject to Medicare?

There is no maximum amount of wages subject to Medicare. Box 6 (Medicare Tax Withheld) is based upon the 2025 rate of 1.45% of wages to Medicare.

Effective January 1, 2013, individuals with earned income of more than $200,000.00 pay an additional 0.9% in Medicare taxes.

Why is Retirement Plan "X'd" in Box 13?

Box 13 is used to identify if an employee is in a retirement or pension plan.

An "X" indicates employees have either deferred compensation into a retirement plan, or were employed at an organization that provides a retirement plan and is eligible to participate.

Why are the wages reported in Box 1 different from Box 3 or 5?

Box 1 and Box 5 may differ due to the following items:

Reaching Social Security maximum wages

Deferred Compensation deductions

Retirement, Part-time/Seasonal/Temporary or Alternate Retirement Plan contributions

Flex Benefit deductions

Tax Sheltered Annuity deductions

Pre-Tax Benefit deductions: Health, Dental, Health Care Reimbursement, Dependent Care Reimbursement, Other Post-Employment Benefits

Pre-Tax Parking deductions

Consolidated Benefits

Why are the wages reported in Box 1 (Federal Wages) different from Box 16 (State Wages)?

The amount in Box 16 state wages and Box 1 federal wages are usually the same if you only worked in one state or if you live in a state where all wages earned are reportable.

However, wages in Box 16 may differ from Box 1 federal wages for the following reasons:

Wages earned in another state

Medical expenses: CA allows an exclusion from gross income for certain employer provided benefits for a taxpayer's registered domestic partner and that partner's dependents

California does not conform to federal law regarding health savings accounts (HSAs)

CA taxpayers cannot deduct contributions to federal HSA from their California Wages. It’s not excluded as income and is added to the taxpayers CA wages.

Ride-sharing benefits

Sick pay under FICA

Income exempt by U.S. treaties: This applies to the employees from the country that has a treaty with the US

California and New York don’t conform to the federal suspension of exclusion from income-qualified moving expense reimbursements under the 2017 federal tax law, HR.1, Pub. L. 115-97. CA and New York allow exclusion from income for qualified moving expense reimbursements.

Are fringe benefits reported on the Form W-2?

Yes, fringe benefits are reported in Boxes 1 and 14 (Other).

This amount will also be included in Boxes 3 and 5, if applicable.

Are Deferred Compensation or Tax Sheltered Annuity deductions reported on the Form W-2?

Yes, employees who have Deferred Compensation or Tax Sheltered Annuity deductions withheld will have the deduction amounts reported in Box 12 with codes "D" for 401(k), "G" for 457(b) and "E" for 403(b).

What other amounts are reported in Box 12?

Code "C": The imputed value of group term life insurance coverage in excess of $50,000

Code "L": Non-taxable standard mileage reimbursement amounts up to the state's allowances (Military Only)

Code "P": Excludable moving expense reimbursements paid directly to a member of the U.S. Armed Forces (not included in box 1, 3, or 5)

Code "AA": Designated Roth contributions under section 401(K) plan

Code "BB": Designated Roth contributions under section 403(b) plan

Code "DD": The cost of employer-sponsored health coverage. The amount reported is not taxable.

Code "EE": Designated Roth contributions under a governmental section 457(b) plan

Why did I receive a W-2 with an incorrect social security number or two-or-more W-2s with different social security numbers?

Contact Wrapbook Support for assistance.

I recently changed my name. So why did I receive a W-2 with my former name?

The W-2 will use the name that you had for your first payment issued in the tax year.

If your Social Security number is listed correctly on the form, the name difference shouldn’t be an issue when filing your taxes.

What is a 1095‑C and do I need it to file taxes?

Form 1095-C is an Employer-Provided Health Insurance Offer and Coverage statement required by the Affordable Care Act (ACA). It is provided by Applicable Large Employers (ALEs) (those with 50 or more full-time equivalent employees) to their full-time employees to report information about the health coverage offered to them and their families.

If your production used Wrapbook-managed benefits, your 1095-C will be mailed to you and also available online via Employee Navigator

Some taxpayers may not receive a Form 1095-C by the time they are ready to file their tax return. While the information on these forms may assist in preparing a return, they are not required. Individual taxpayers should not wait for these forms and file their returns as they normally would. Taxpayers can prepare and file their returns using other information about their health insurance. You should not attach any of these forms to your tax return.

Why doesn’t my 1095‑C say “Wrapbook”?

The form lists the production company’s name, not Wrapbook.

When will I get my 1095‑C?

If you employer used Wrapbook-managed benefits, you can expect the form by mid‑April

If your employer used Wrapbook-managed benefits, you will also be able to access your form via the Employee Navigator by March 31.

If you forget your Employee Navigator password or need help access your account, please contact benefits@wrapbook.com.

Where do employer medical benefit contributions show up?

When Wrapbook manages your benefits, the contributions will appear on your W‑2, in Box 12.

Who do I contact with questions about Wrapbook-managed benefits?

You can email the Benefits Team at benefits@wrapbook.com for benefits and ACA questions.

I worked on a production in Canada. Which tax slip will I get?

The tax slip you’re issued depends on your residency and whether you were paid as an employee or loan out:

Canadian residents:

U.S. or other non-residents:

Employees receive a T4 slip

Behind-the-scenes loan outs usually receive a T4A-NR slip, showing a 15% withholding rate

Accessing your Canada tax slips

You can expect Canada tax slips by mid- to late February. In Wrapbook these will be issued as follows:

US citizens and other non-residents can access their Canadian slips in their Tax documents (or by mail if opted-in for a paper copy)

Canadian residents will be mailed a paper copy of their T4 or T4A slips

Even if you’re a U.S. citizen, you must report this income to the IRS and can claim foreign tax credits for taxes paid to Canada.

To learn more, see the official information on the Canada Revenue Authority (CRA) website.