About Tax Documents

The Tax Documents dashboard gives you centralized access to all tax forms issued through your company, by worker - across all projects.

Note: The Tax Documents dashboard can be used to review and download tax forms for specific workers. If you prefer to bulk download project worker tax forms, you can do so from the project’s Documents dashboard.

Ways to use the Tax Documents dashboard

The Tax Documents dashboard in Wrapbook is especially useful for:

Review and verify worker tax documentation for your projects

Access individual tax forms for specific workers

Ensure all required tax forms are on file before processing payroll

Export 1099 forms for contractors (for those earning $600 or more annually through Wrapbook)

What’s on the Tax Documents dashboard

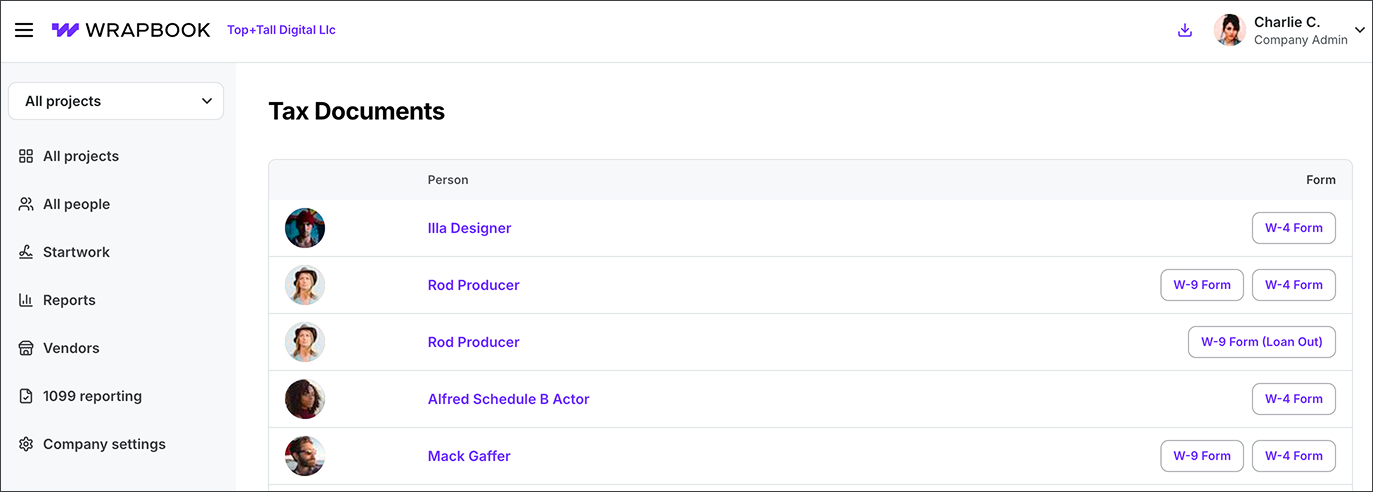

The Tax Documents dashboard displays the following tax forms for workers on your company's projects in Wrapbook:

W-4

W-9

1099

How to access project worker tax documents

Use these steps to access W-4, W-9, and 1099 tax forms for your company’s project workers:

In the left-side navigation, click the dropdown menu

In the dropdown menu, select All projects

In the left-side navigation, click Reports

On the Reports dashboard, under Tax Documents, click the View report button

You can view and export individual tax forms (PDF) by clicking the buttons next to specific workers

Example of a company's Tax Documents dashboard in Wrapbook

Pro tips

SSNs and EINs are redacted by default for privacy and security

Your ability to view redacted information depends on your assigned role and permissions in Company settings. To learn more about this security measure, click here.

Workers can access their own W-2s and year-end tax forms directly through their personal Tax documents dashboard