In Wrapbook:

Your worker classification is set per project by the production

Your worker type may differ from one project to another

If your worker classification is incorrect on a project, contact the project’s production administrators and ask them to update it

The classification of the worker determines how the worker is paid, how taxes are handled, what forms they receive, and which employment protections apply to them.

In Wrapbook, you may be classified by your employer as an Employee (W-2) or a Loan Out (Company). In limited cases, you may also be classified as a Contractor, depending on state law and production rules.

This guide explains what each classification means and how to confirm your worker type in Wrapbook.

Why your classification matters

Your worker classification affects:

Whether Wrapbook withholds taxes on your behalf

Whether you are covered under workers’ compensation

How your unemployment insurance is handled

Which tax forms you receive at the end of the year

Which onboarding information you’ll be asked to provide

Correct classification is required under U.S. employment law and state-specific rules (such as the ABC Test or Common Law Test) that set guidelines for determining whether a worker is an Employee or Independent Contractor.

Worker types in Wrapbook

Your worker classification is set per project by production and your worker type may differ from one project to another.

The summaries below explain how each worker type is paid, taxed, and which year‑end forms to expect.

Employee (W-2)

Most production workers are classified as W-2 Employees.

When you’re classified as an Employee:

Wrapbook becomes your Employer of Record for tax withholdings and unemployment insurance

Wrapbook withholds applicable federal, state, and local taxes

You are covered under Wrapbook’s workers’ compensation policy

Your earnings are taxed under your SSN

At year-end, you receive a W-2

Loan-Out (Company)

If you have a business entity that provides your services (often called a Loan-Out Company), you may be classified as a Loan-Out.

To be paid as a Loan-Out in Wrapbook, your company must:

Be incorporated as an S-Corp, C-Corp, or an LLC filing as an S-Corp or C-Corp

Have an active Employer Identification Number (EIN)

Provide complete tax and incorporation details during onboarding

Other business types are not eligible to be serviced as Loan-Outs.

When you’re classified as a Loan-Out:

You receive a 1099-NEC for payments made to your company

Wrapbook does not withhold payroll taxes

You, as the owner of the Loan-Out, are covered under Wrapbook’s workers’ compensation policy

You must provide full company tax information in your Wrapbook profile

Information you’ll be required to submit:

Company Legal Name

EIN

Federal Tax Classification

Business Address

Jurisdiction of Incorporation

Articles of Incorporation (production companies that use Wrapbook have the option to request this documentation )

Payment methods for Loan-Out workers

Loan-Outs may be paid in one of two ways:

Time-based payment

Recommended in general, and required for unionized Loan-Out workers

You submit a timecard through Wrapbook

Your hours and rates are approved by production

Wrapbook issues payment to your Loan-Out entity

Invoice-based payment

You submit invoices instead of timecards

Production reviews and approves your invoice

Wrapbook issues payment to your Loan-Out entity

Contractor classification

Some workers may be hired as Independent Contractors, but this is rare in entertainment.

What to know about Contractor status:

Many jurisdictions apply one of several classification tests, most commonly:

ABC Test – a strict statutory test used in states such as CA, NJ, and MA

Common Law Test – a control-focused test used by the IRS and many states

Economic Realities Test – used by the U.S. Department of Labor for FLSA purposes

When you’re paid as a Contractor:

The production company is your Employer of Record (not Wrapbook)

No payroll taxes are withheld by Wrapbook or the production company

You receive a 1099-NEC from the production company

Contractors may elect to have backup withholding in Wrapbook. When this is elected, Wrapbook withholds 20% per the backup withholding rules.

How to confirm your worker classification

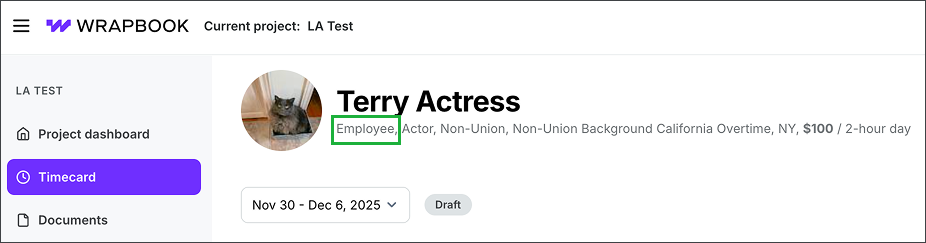

You can view your worker type from your project’s Timecards dashboard in Wrapbook.

Your worker classification is listed on your project timecards

How to change your worker type in Wrapbook

In Wrapbook, worker classification is set per project by the production employer during onboarding. If your situation has changed or you were set up incorrectly:

Contact your production administrators and ask them to update your worker classification before the next payment

Future payments will follow the updated worker type

Past payroll and reporting remain as originally processed

FAQ

To help you understand worker classification in Wrapbook, we’ve put together this list of frequently-asked questions.

What happens if my payment for work is sent to a different type of bank account?

Sometimes funds are sent to a different type of bank account for example:

Loan‑Out classified worker paid to a personal account

Employee classified worker paid to a business account

The good news is that your payroll and tax reporting will remain accurate even if the destination account type doesn’t match. In Wrapbook, reporting follows your worker classification and the payroll run, not the bank account type.

If funds are deposited into the wrong bank account, please transfer the money between your own accounts through your bank. Wrapbook Support cannot move funds between your accounts.

I’m union. Does that make me an Employee?

Union status doesn’t automatically define your worker classification. Classification is based on how the production onboarded you for the project.

Will I get both a W‑2 and a 1099 from the same production?

Possibly, if you were classified differently on different projects or for different engagements.

My pay stub doesn’t show withholdings. Is that wrong?

Not necessarily. Vendors and Loan‑Outs typically do not have Employee tax withholdings. Employees do.

Can I pick my worker classification?

Speak with your production administrators. Remember, workers must be classified in a way that aligns with company policy, jurisdictional rules, and your documentation.